TEXT Otávio Veras, Research Associate at the Nanyang Technological University and the Singapore Business Federation

China picks Brazil as springboard for investment in Latin America

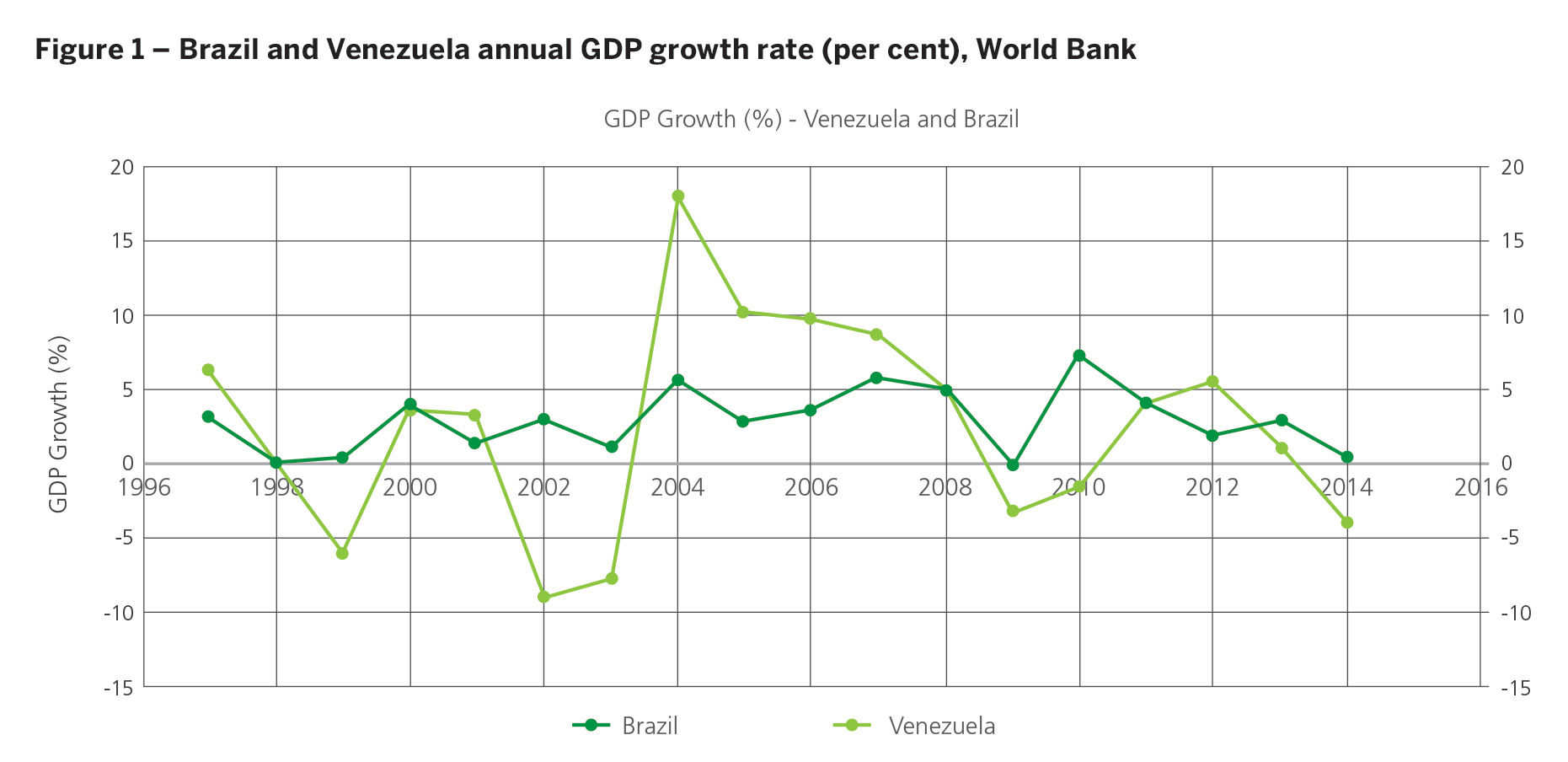

When looking at Latin America, China has historically focused its foreign direct investment in Venezuela. In recent years, however, Venezuela has fallen into major economic depression as a result of poorly crafted public policies and heavy dependency on crude oil exports in a depleted global oil market. In this adverse environment, China began diversifying its investments in Latin America and chose Brazil as one of the main destinations for foreign direct investment in the region.

The search for a trading partner with a more diversified economy comes as a result of China’s economic shift from the largest importer of raw materials to a major investor in more complex industries. Manufacturing, logistics, and technology have attracted more attention in China in recent years than the base infrastructure segment did. Even in the absence of a severe economic depression, Venezuela does not constitute a versatile partner; the nation’s economy has revolved around crude oil production for decades.

Brazil has also faced its share of crises in recent years. The end of the commodities supercycle that brought down the prices of iron ore and oil has degraded much of Brazil’s economy since 2014. The political turmoil that led to ex‑president Dilma Rousseff’s impeachment last August still persists, and investigations into state‑owned oil company Petrobras continue to expose politicians found to have been part of the ongoing corruption scandal.

Brazil has seen better times. The period from 2000 to 2008 marked the golden years of the Brazilian dream. The country grew at an average rate of 3.75 per cent per year (see Figure 1). Industry and commerce diversified and poverty levels decreased. The solid base built during those years sustained Brazil as an attractive investment destination.

Brazil and China relations today

The growth in mergers and acquisitions in Brazil from China shows the voracious appetite of the Asian investor. Dealogic, a financial markets platform company, reported that Chinese acquisition of Brazilian firms surpassed US$11.9 billion (MOP95.4 billion) in 2016, reaching a 6‑year historical high. The investments were mostly concentrated in the utilities sector but also ranged from food and beverage to transportation sectors.

Between 2013 and 2016, the World Bank lent a total of US$6.5 billion (MOP52.1 billion) to Brazil. In the same period, Chinese lending to the tropical country totalled US$25.7 billion (MOP206 billion). The last remittance of this amount occurred in October 2016 when China and Brazil signed a joint investment fund called the Brazil‑China Cooperation Fund for Increasing Production Capacity with a budget of US$20 billion (MOP160.3 billion) to begin financing of infrastructure projects in 2017. China invested US$15 billion (MOP120.2 billion) and Brazil contributed the remaining US$5 billion (MOP40 billion).

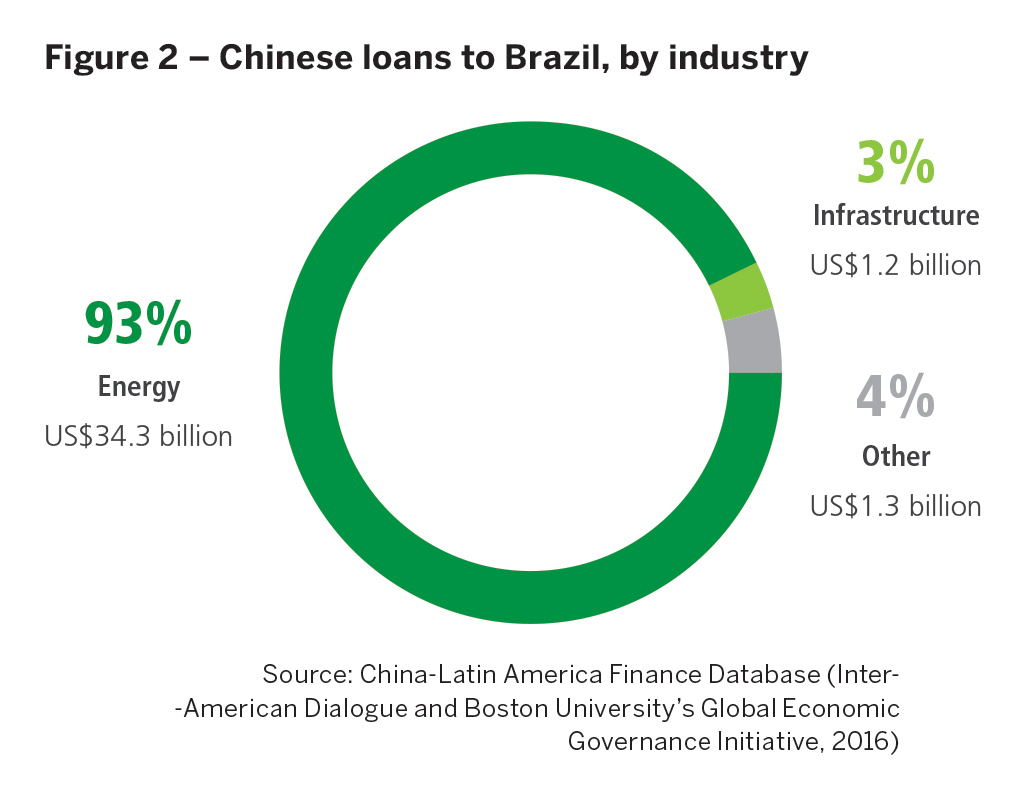

Estimates produced annually by the Inter‑American Dialogue and Boston University’s Global Economic Governance Initiative show that more than 87 per cent of the Chinese loans to Brazil were provided by the Chinese Development Bank (CDB), with the remaining coming from the Chinese Export‑Import Bank. Most of the projects financed by this lending lie in the Energy sector (see Figure 2).

Renewable power and energy distribution

Renewable power drew a portion of the energy‑related investments from China. The growth of wind and solar power is still centred in small‑scale distributed generation but has so far attracted new Chinese players such as Huawei, BYD, Yingli, and Goldwind.

In August 2016, Huawei signed its first contract to supply special equipment for 3 photovoltaic projects totalling 90 megawatts (MW) of energy output in solar projects in the state of Minas Gerais, southeast Brazil.

In April this year, BYD opened its solar panels factory in the state of São Paulo, also in southeast Brazil, where it already has an assembly line for its electric vehicles. With an initial investment of US$47.2 million (MOP378.4 million), the plant will have a production capacity of 200 MW. BYD chose Brazil for its solar‑manufacturing plant because of the country’s growing solar capacity. Brazil’s solar sector is expected to leapfrog from 30 MW of solar power and 39 power plants, in 2016, to 2.7 gigawatts (GW) of solar power and 134 power plants, by 2019.

In early 2016, JA Solar, a Chinese solar development company, signed a contract for construction of a 300 MW manufacturing plant in Brazil. Based in Shanghai, JA manufactures solar cell and solar panel products. Jinko Solar is another Chinese player tapping the Brazilian solar market. With manufacturing plants in Jiangxi and Zhejiang, Jinko Solar imported 11 MW of panels for solar farm in Pernambuco state, in northeast Brazil. The company also won an order to supply a 30 MW plant to the Brazilian government.

The growth in mergers and acquisitions in Brazil from China shows the voracious appetite of the Asian investor. Dealogic, a financial markets platform company, reported that Chinese acquisition of Brazilian firms surpassed US$11.9 billion in 2016, reaching a 6‑year historical high

Brazil, in fact, has attracted many new foreign players in the solar industry. The agreements Brazil signed at the 2015 Sustainable Innovation Forum (COP21) total US$40 billion (320.6 billion) in solar projects until 2030. This year, 3.3 GW in solar projects were awarded in public auctions. Brazil also conditions development bank funding to the requirement that the foreign company must employ a minimum number of local employees when setting up a business in the country, which helps create employment and builds local expertise. According to the Brazilian Association for Solar Photovoltaic Energy (ABSOLAR), solar energy‑related projects awarded via public auctions in Brazil are expect to total US$4.25 billion until 2018. The country has plans to change its electricity generation matrix to include 10 per cent solar by 2030, a considerable increase from the current 0.01 per cent.

The New Development Bank (NDB) is also involved in the financing side of many solar projects. Created in July 2014, the NDB was set up by the BRICS nations (Brazil, Russia, India, China, and South Africa) as a multilateral development bank with a focus on infrastructure and sustained development projects. In April, the bank signed its first loan to finance projects in Brazil. Another US$300 million from the Brazilian National Development Bank (BNDES) will match the US$300 million (MOP2.4 billion) loan and the amount will be used entirely in renewable energy ventures, potentially adding 600 MW to Brazil’s energy grid.

On the utilities side, giant State Grid Corp. of China (SGCC) concluded in January the purchase of a majority stake in Brazil’s CPFL Energia S.A., the largest power distribution company in the Latin American country, for US$4.49 billion (MOP35.9 billion). SGCC is the world’s largest electricity utility company, employing over 1.9 million staff and generating annual sales of US$330 billion (MOP2,645 billion). The company has a long‑term vision of creating a global network of interconnected transmission lines, which could allow electricity transmission from regions of high renewable resources to those of high demand.

In 2014, SGCC had already set foot in Brazil, through a 51/49 per cent joint venture with Brazilian state‑owned electricity company Eletrobras. The agreement was part of a plan to connect the new 11 GW hydroelectric dam at Belo Monte, in the Amazon, to the grids in São Paulo and Rio de Janeiro, both more than 2,000 km away. The US$4.7 billion (MOP37.7 billion) project is due for commissioning in 2018.

Another Chinese giant that has reached far into Brazil is the world’s largest dam operator, China Three Gorges Corp. (CTGC). In January 2017, the company finalized a US$3.7 billion (MOP29.7 billion) deal for the 30‑year right to run two projects in Brazil: the 3.4 GW Ilha Solteira plant and the 1.5 GW Jupiá plant. This came one month after CTG acquisition of Duke Energy’s assets in Brazil for US$1.2 billion (MOP9.6 billion). The transaction added 2.27 GW of power generation to its portfolio in the Latin American country. Currently, CTG has 8.27 GW of installed capacity in Brazil, more than state‑run energy company Eletrobras at 6.8 GW.

Railways

Two gigantic railway projects taking place in Brazil will likely to have Chinese companies as main partners. The first venture is a railway connecting Brazil’s Atlantic coast and Peru’s Pacific coast. The 3,755‑km long railway will connect the Brazilian port of Santos to the Peruvian port of Ilo, crossing Brazil, Bolivia, and Peru, as well as a region of the Andean mountains, on the way (see Figure 3). The US$60 billion (MOP480 billion) railway will drastically shorten shipping routes from Brazil’s coast to Asian markets for commodities, reducing the cost of shipping minerals, grains, and soybeans to Asia.

Brazil is expected to export 61 million tonnes of soybeans in the 2016‑17 crop year, according to the United States Department of Agriculture (USDA). It is the world’s largest soybean exporter. The trans‑Andes rail link will allow Brazilian soybeans to be shipped from Pacific ports in Peru to Asia, bypassing the Panama Canal. The project was put on hold late last year, though, due to cost and environmental concerns.

The second large endeavour in railway infrastructure in Brazil is a high‑speed train connecting Rio de Janeiro and São Paulo, the two largest cities in Brazil. The project, planned by Chinese firms, was first proposed in 2010, when the economy was booming. At that time, the plan was to have the train up and running by 2016, when the Olympics happened in Rio. However, the project was repeatedly delayed due to doubts over its viability and concession models. Reuters reported that Chinese companies believe the project is economically viable, but want the Brazilian government to propose a new concession model before making a final decision. The bullet‑train railway will be 400‑km long and have a price tag of US$11 billion (MOP88 billion).

Railway construction spending abroad has been adopted as a viable solution for China’s excess capacity in steel, rail, construction and engineering services as the economy slows. A rail programme fits China’s preference for government‑to‑government infrastructure deals that can be allocated to state‑owned companies, which remain wary of complex Latin American tax and labour laws.

Commodities

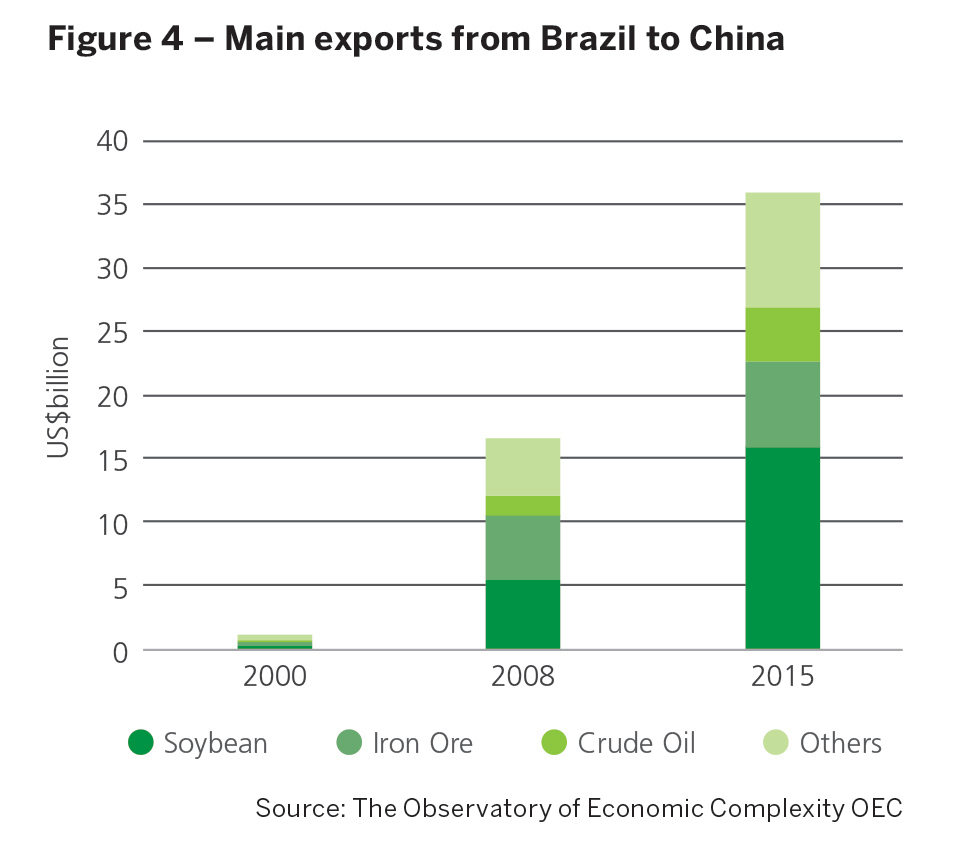

Historically, commodities trading has been the essence of most of the business between China and Brazil. Between 2000 and 2010, Brazil’s economy grew 3.4 times and the GDP per capita jumped from US$3,700 (MOP29,660) to over US$11,100 (MOP88,980). China’s appetite for soybeans, iron ore, and oil played a large role in propelling this growth. In 2000, Brazil was exporting US$1.2 billion (MOP9.6 billion) to China, from which soybeans, crude oil, and iron ore accounted for 56 per cent of the total. By 2015, exports from Brazil to China increased 31 times, totalling US$35.9 billion (MOP287.8 billion), and became much more focused: soybeans, crude oil and iron ore accounted for 75 per cent of what Brazil sold to China (see Figure 4).

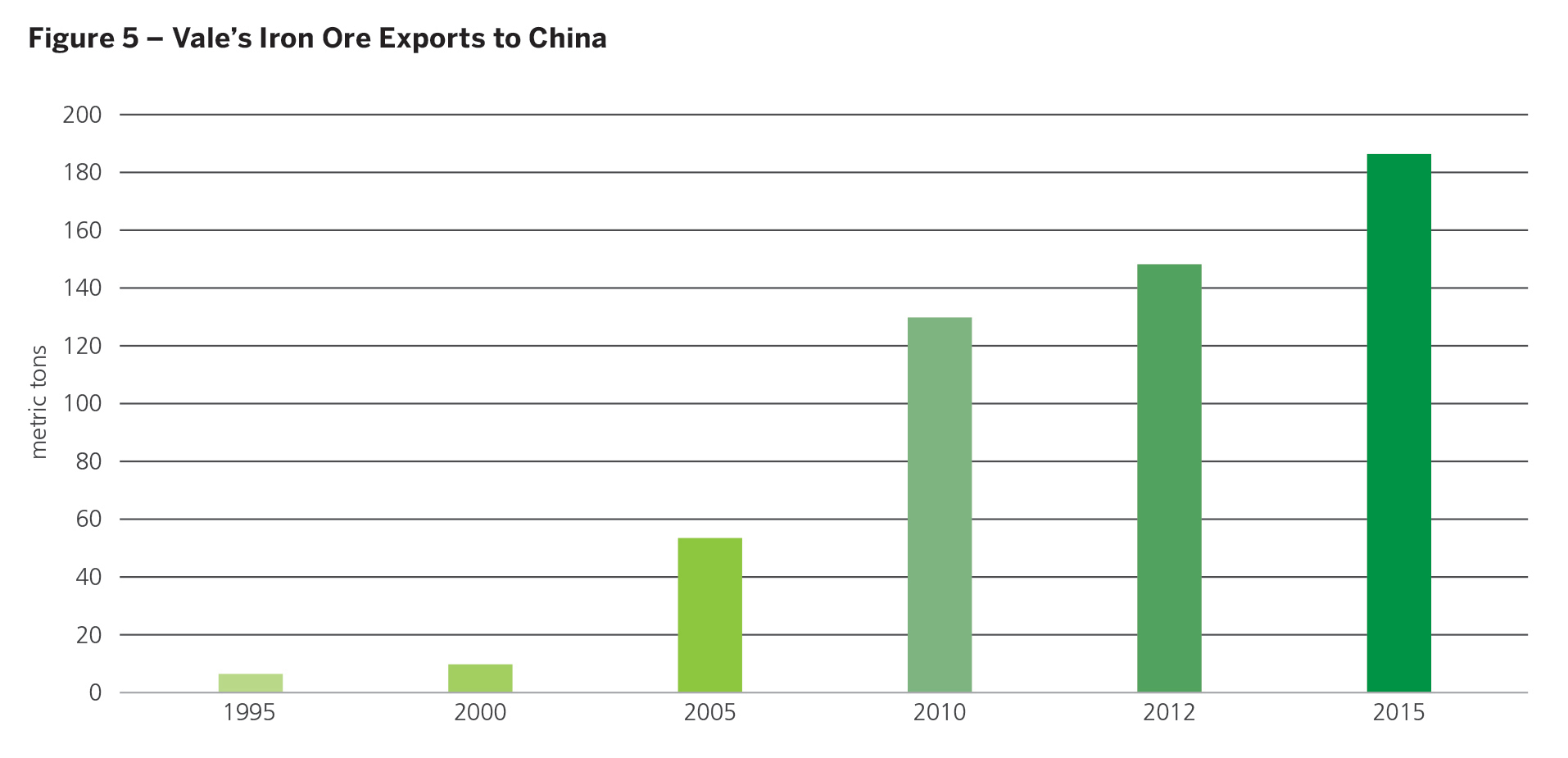

Iron ore exports are highly concentrated in one company, Vale S.A. (the former CVRD Companhia Vale do Rio Doce), which has benefitted greatly from exports to China over the past decades. Vale was the first company in the world to export iron ore to China, back in 1973. The company is central to the history of trade between China and Brazil. Former Chinese ambassador to Brazil Chen Duqing (2006–2009) once described the company as “the anchor of Brazil’s relations with China.”

Iron ore exports are highly concentrated in one company, Vale S.A. (the former CVRD Companhia Vale do Rio Doce), which has benefitted greatly from exports to China over the past decades. Vale was the first company in the world to export iron ore to China, back in 1973. The company is central to the history of trade between China and Brazil. Former Chinese ambassador to Brazil Chen Duqing (2006–2009) once described the company as “the anchor of Brazil’s relations with China.”

From the 1980s until the end of the century, China experienced a large shift from a rural economy to one focused on manufacturing and construction. The ceaseless migration from rural China to urban centres drove demand for housing and infrastructure, which have sustained the construction industry and accelerated demand for minerals.

Chinese steel production grew at an average annual rate of 7 per cent in the 1980s, 10 per cent in the 1990s and nearly 20 per cent in the first decade of the 21st century. As a result of this performance, China became the largest steel producer in the world. In 1997, when the country was still feeling the effects of the Asian financial crisis, its steel mills produced 108.91 million metric tons of crude steel – 13 per cent of the global supply. By 2010, output had climbed to 626.65 million metric tons, amounting to 45 per cent of the global supply. In 2015, China produced 803.8 million metric tons of crude steel, or 49 per cent of the global production.

The growing Chinese steel industry resulted in an increase in consumption of iron ore, a raw material for steelmaking. China started to import high iron content Brazilian ore from Vale and, in the process, became a major commercial partner of Brazil. Despite the large distance between the two countries, Vale’s sales to China grew from 10 million metric tons in 2000 to 186.9 million metric tons in 2015 (see Figure 5).

Today, Vale participates in several coal, nickel, and iron ore pelletizing operations in the Chinese cities of Zhuhai, Anyang, Yanzhou, Yongcheng, and Dalian. The company is also a partner in two pellet companies – Anyang Yu Vale Yongtong Pellet Co. and Zhuhai YPM Pellet Co. – each capable of producing 1.2 million metric tons of iron ore pellets. Vale has a 98.3 per cent stake in Dalian Nickel Refinery (Vale Nickel Dalian Co.), with a nominal capacity of 32,000 metric tons per year.

Vale, together with Chinese Yankuang Group and Japanese Itochu partners, began joint development of a coking plant in Yanzhou, located in the province of Shandong, with an estimated annual production capacity of 1.7 million metric tons. Vale has also developed close relations with Baosteel, the country’s largest steel producer. The companies now work together at Água Limpa mine, in Minas Gerais, Brazil.

In 2012, the state‑owned petroleum company, Petrobras, eclipsed Vale S.A. as the country’s largest commodity exporter to China. In the recent years, Petrobras has been mired in Brazil’s worst‑ever corruption scandal just as the Latin American nation goes through a recession. The company ran into difficulty accessing capital from western banks and was impeded from operating in the bonds market. To balance this situation, Petrobras is implementing a plan to restructure its assets globally, including divestments and partnership programs. The restricted access to loans from western banks, however, opened a range of opportunities to China.

In February 2016, Petrobras secured a US$10 billion (MOP80.2 billion) loan from China Development Bank from agreements signed the year before. By May 2016, the company was seeking a US$1 billion (MOP8.8 billion) loan from the Export‑Import Bank of China. The financing is tied to equipment and service contracts from Chinese suppliers, and was originally planned for 2017. In December 2016, Petrobras signed definitive terms for a US$5 billion (MOP40 billion), 10‑year financing agreement with China Development Bank and an oil supply accord with Chinese companies.

Crude oil sales from Petrobras to China in January and February totalled 40.8 million barrels, up 125 per cent from the same period in 2016 and more than 10 times Brazil’s shipments to the country five years ago, according to Reuters.

Food industry

Another Brazilian firm that has China as a growing market is BRF Global, a food sector multinational and one of the world’s largest poultry suppliers. BRF sells more than 4 million tonnes of food and is present in more than 150 countries. In 2016, China accounted for nearly one‑third of the Brazilian meat industry’s US$13.9 billion (MOP111.4 billion) in exports, making the country strategic for BRF.

The company has built a sizeable market in Hong Kong, where it has small processing units for pork and chicken meat exported from Brazil. BRF’s popular brand Sadia sold 47 per cent of Hong Kong’s frozen chicken market share in 2012. As part of the strategy to expand into mainland China, in 2015, BRF introduced a line of packed Pao Jiao Feng Zhua (chicken feet with pickled peppers), a famous delicacy in China and in other Southeast Asian countries.

In November 2016, the company acquired US$20 million (MOP160.3 million) in stocks of COFCO Meat, a fast‑growing pork company in China. COFCO Meat has 47 hog farms, two slaughtering facilities, and two processed meat plants in China.

More recently, BRF’s growth in China has been negatively affected after a corruption investigation into Brazilian meat industry revealed that health regulations were not being properly followed in 21 of the 4,800 meat processing units in Brazil. Regardless of the apparent small proportion of the problem, the scandal affected BRF and other Brazilian meat exporters, who had their exports banned from entering China in March 2017. The ban lasted only five days, though; Brazilian authorities clarified that Brazil meat exports to China were safe since they were not processed by any of the implicated plants.

Lasting partnership

During Dilma Rousseff’s presidency the ties between Brazil and China remained strong, even amid the downfall of commodities prices and slowdown of China’s economic growth. In May 2015, during a tour in Brazil, Colombia, Peru, and Chile, Chinese Premier Li Keqiang and President Rousseff announced more than US$53 billion (MOP 424.9 billion) worth of trade and investment between the two countries. China’s Bank of Communications Co. announced it had bought 80 per cent of midsize Brazilian bank Banco BBM S.A. for US$173 million (MOP1.4 billion), in the first overseas acquisition by the mainland bank.

Just over one year later, Rousseff was impeached over accusations of manipulating the government budget. Michel Temer, her vice‑president, was quick to reassure China of its importance as a major trading partner. In September 2016, in his first international trip as president, Temer attended the G20 event in Shanghai. The event gathered over 100 Brazilian and 250 Chinese businessmen, and sealed some highly relevant contracts between Brazil and China.

There are continuous efforts from both Brazil and China to nurture this trading relationship. Brazil’s current political situation shows some instability as investigation into the Petrobras corruption scandal continues to expose politicians involved in the scheme. Added to that, the country is still caught up in an economic crisis that started when global crude oil prices plummeted in 2014. Recession brought a slowdown to Brazil’s economy and decreased government spending in education and infrastructure, key sectors to attract foreign investment. China, with its growing middle class and shifting focus to services and consumer goods industries, offers an opportunity for Brazil to further diversify its industry and get the economy back on track.