China has become one of Portugal’s key partners and the main source of foreign direct investment

A group of Chinese travellers was pleased, and slightly bewildered, upon arriving at Lisbon Airport in the early morning of 26th July. They stepped off their 13‑hour flight to smiling members of the Portuguese government and airline executives standing at the end of a red carpet, eager to greet them.

With Portugal’s tourist boom, new flights at Lisbon Airport have become commonplace, but none has had such a reception, which included champagne and the “national sweet” (custard tarts) for the tired newcomers. No other direct connection between two countries has sparked so much interest from the Portuguese government. Over the last few years, China has become one of the country’s key partners and the main source of foreign direct investment. Another step in strengthening a relationship that holds so much promise in terms of future developments clearly merits a little celebration.

The launch of the thrice‑weekly Hangzhou– Beijing–Lisbon flight operated by Beijing Capital Airlines, a subsidiary of HNA Group, is expected to further boost economic ties between the two countries. It also holds major political significance. The high‑level involvement in the project is only paralleled by the US$3.5 billion acquisition of 21.35 per cent of EDP‑Energias de Portugal, Portugal’s national energy company, by China Three Gorges (CTG) in 2011. That privatisation agreement was signed at the highest level, with the then deputy prime minister and minister of finance.

HNA Group also indirectly holds a stake in TAP Portugal, the Portuguese flag‑carrier airline recently privatised in a bid won by the Atlantic Gateway consortium, via a bond buy from Azul Brazilian Airlines in 2016; David Neeleman, the chairman of Azul Airlines and founder of JetBlue, also heads Atlantic Gateway with Portuguese partner Humberto Pedrosa.

Prior to the greeting ceremony, the Portuguese Prime Minister António Costa attended a presentation of the project with Zhang Dejiang, chairman of the Standing Committee of the National People’s Congress. According to Costa, who visited China in October 2016, the new air link will develop the relationship between Lisbon and Beijing while also assisting in the establishment of Portugal as a “major intercontinental hub” for European routes to and from South America and Africa.

The Portuguese government has shown great interest in the Belt and Road (B&R) initiative. In the greeting ceremony for the first Chinese travellers, Infrastructure Minister Pedro Marques called the Capital Airlines flights “the new air silk route for the 21st century”, further affirming his country’s commitment to the initiative. “Relations between the two countries have become very strong and intense over the last few years,” Marques said, noting the positive impact of the Portuguese prime minister’s successful visit to China.

Ease of Travel

The number of Chinese tourists visiting Portugal has increased considerably in recent years. In 2016, there were 200,000 Chinese visitors to Portugal – without the benefit of a direct flight to the country.

According to Jorge Torres‑Pereira, the outgoing Portuguese ambassador to Beijing, Portugal could reach the ambitious growth rate of one million Chinese tourists a year. More than 135 million Chinese travelled abroad in 2016, up 6 per cent from the previous year, and that number is expected to increase to 200 million by 2020. Portugal currently has nine visa centres in China: Beijing, Shanghai, Hangzhou, Nanjing, Chengdu, Shenyang, Wuhan, Fuzhou, and Guangzhou. HNA‑Caissa, one of China’s leading tour operators, is owned by the same company behind the Beijing– Lisbon route, HNA Group. With the introduction of the Beijing–Lisbon flight, accessing Portugal will be more convenient than ever before.

Early indications of the new direct flight are positive. According to Capital Airlines, the first four flights were nearly full. The airline also plans to open a Macao–Beijing flight, which will coincide with the connection to Lisbon, in order to serve the 15,000 Portuguese residing in the territory. For Torres‑Pereira, the direct link is “important to maintain the dynamics of a bilateral relationship that is effectively expanding,” noting that Chinese investments in Portugal have gone from “tens of millions of euros to billions of euros.”

Chinese tourists are known in Europe as big spenders. According to World Tourism Organization (UNWTO) figures, Chinese tourists spent US$261 billion abroad in 2016, 12 per cent more than the previous year. Studies conducted in Portugal show that Chinese tourists are spending the most in shopping; some of Lisbon’s main shopping centres have begun offering new services, including tours in Chinese, to attract their business.

Tourism and real estate have become hotspots for the Portuguese economy, and according to Reuters, the economy grew 2.8 per cent from 2016; a modest level for Asian parameters, but unseen in Portugal for over a decade. Tourism growth proved crucial for the country during the recession years of 2010 and 2011.

Small‑scale Chinese investors have also had a major role in the real estate market by participating in the Portuguese Golden Visa programme, launched in 2012. The latest Immigration and Borders Service (SEF) data shows that investment attracted by golden visas rose 14.8 per cent in the first seven months of the year, compared to the same period of 2016, to EUR656 million (US$771 million). Total investment since 2012 amounted to EUR3.22 billion (US$3.79 billion), the majority of which corresponds to the purchase of real estate. Of the total of visas granted, 4,849 involved the acquisition of real estate, 288 for capital transfers, and 8 for the creation of at least ten jobs. China was by far the country with most visas granted: 3,472 by June 2017, followed by Brazil (432), South Africa (201), Russia (179) and Lebanon (103).

Bonds Behind The Belt and Road

A recent study by Spain’s ESADE Business & Law School found that Portugal is currently the main destination of Chinese investment in Europe. A number of Chinese firms have acquired stakes in Portuguese companies, including the previously noted CTG acquisition. The State Grid Corporation of China acquired 25 per cent of REN- Redes Energéticas Nacionais, the operator of Portugal’s national power grids. Fosun became the largest shareholder of Millennium BCP, Portugal’s biggest private bank, when it upped its stake to 24 per cent in February 2017. Fosun already owns the country’s largest insurance company, Fidelidade, and the largest private healthcare provider, Luz Saúde. Each firm has a substantial presence in Portuguese‑speaking countries, and trilateral cooperation has become a focus.

Transportation is another sector the Portuguese government believes it can rely on for future economic growth. Officials believe China can play a major role in boosting the sector, particularly within the B&R strategy.

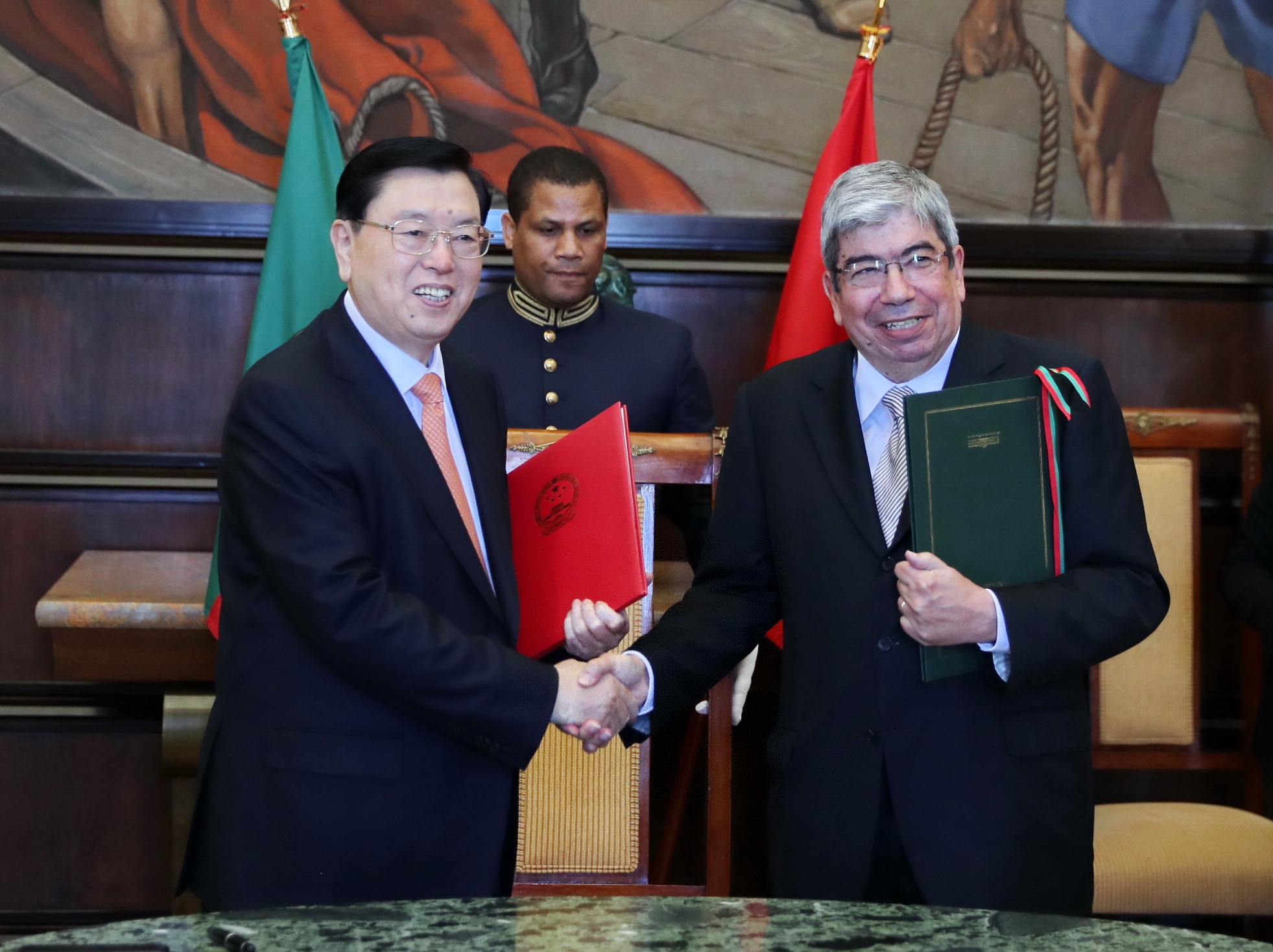

During his visit to China in 2016, Prime Minister Costa signalled his country’s willingness to participate in the initiative, noting that developing the Port of Sines as part of the Maritime Silk Road would make the most of his country’s strategic position to “deepen the connection between Asia, Europe, Africa, and South America.” The first Memorandum of Understanding on cooperation, signed on 11th July, makes reference to Portugal’s role in the B&R initiative. Chairman Zhang, along with his Portuguese counterpart Eduardo Ferro Rodrigues, signed the agreement during his visit to Lisbon, which states that, “within the framework of their responsibilities, both parties will support their governments in improving the documents and consolidating the legal basis for bilateral cooperation in all areas.” It also specifies that cooperation covers the B&R initiative “in order to create a better legal and political environment for enhancing mutual political trust, promoting economic and trade cooperation and exchanges between the two peoples.”

Speaking at a seminar in Lisbon at the Higher Institute of Economics and Management in late June, Chief Executive of Partex Oil and Gas António Costa Silva said that increasing the involvement of Portuguese ports in international maritime traffic networks offered important opportunities for the country. In addition to improved infrastructure, he noted the opportunity for “strategic port positioning, openness to new markets, development of information technologies, integration into the global logistics chain, consolidation of a multi‑purpose Portuguese port centre that meets the requirements of the market, attracting investment to the ports.”

As China expands the geographical scope of B&R, financing will be key to developing ports like Sines into a more effective gateway for European markets. Opening up to foreign debt issuance through the so‑called “Panda bonds”* is a way for the Chinese government to internationalise the renminbi, while also providing critical financial resources to the countries involved in the B&R initiative.

Portugal recently confirmed it is preparing to issue debt on the Chinese financial market, becoming the first country in the eurozone to join the Panda bonds. The spokesman for the office of the Portuguese prime minister told Reuters: “In practical terms, the issue aims to diversify the sources of financing of Portugal, opening a new market for its debt, and support the internationalisation of the [renminbi].” In May, Portuguese Finance Minister Mário Centeno said that selling bonds in renminbi would allow Portugal to take advantage of rising demand for its debt at a time when its credit rating is expected to improve due to a better economic outlook.

Speaking to Reuters in July this year, Hong Kong‑based Richard Mazzochi of the KWM law firm said that the issuance of Portuguese Panda bonds would be easier if it were linked to a specific project. “Applications are easier to make where there is already an established connection and if an issuer would use the proceeds in connection with One Belt, One Road initiatives, that would be helpful,” he explained; Mazzochi, who specialises in banking and finance, has been involved in a number of Panda bond deals.

Connections at Every Level

At a recent meeting in Lisbon, promoted with the support of Fosun‑owned Fidelidade, between Chinese investors and Portuguese entrepreneurs, Secretary-General of the Portuguese‑Chinese Chamber of Commerce and Industry Sérgio Martins Alves encouraged the government to make the most of China’s investment capacity. Channelling funds towards infrastructure projects, he explained, is essential to the development of the Portuguese economy. In addition to the Port of Sines, Martins Alves referenced the new Lisbon airport and high‑speed railway as potential beneficiaries of Chinese investment.

Portugal is not among the 16 European countries currently linked to China via rail links, putting it at a significant disadvantage; linked countries can transport products to China in a fraction of the time it takes Portugal to ship goods by sea. Expanding the railway network would make Portugal more competitive and further strengthen its trade relationship with China.

According to Martins Alves, another key trend for the near future will be Chinese investment in startups and small‑ and medium‑sized enterprises, as most of the large assets are no longer available. But investments by giants like CTG and Fosun attract attention and may have boosted small investors’ confidence in the Portuguese market, which is part of the European Union market of 500 million people, the world’s largest trading bloc.

According to Bloomberg Markets, by August 2017, such bond issuances amounted to US$7 billion.

*”Panda Bonds”: bonds issued in China and denominated in renminbi by a foreign bank or corporation. They are issued when a corporation wishes to raise capital from investors in China.