TEXT Dr. Thomas Chan, President of the Maritime Silk Road Association (Macao)

The Pearl River Delta (PRD) region in southern Guangdong province has proven to be remarkably resilient in its economic development in the last few decades. In the early reform years of 1980s, the region transformed itself from a largely rural and sparsely populated area into a global production base of labour-intensive products. In the 2000s, it moved to producing higher-valued items but faced problems such as rising labour costs and industry-related environmental degradation. During the global financial crisis of 2008-2009, the region was hit even harder, with shrinking external demand for its exports.

The Pearl River Delta (PRD) region in southern Guangdong province has proven to be remarkably resilient in its economic development in the last few decades. In the early reform years of 1980s, the region transformed itself from a largely rural and sparsely populated area into a global production base of labour-intensive products. In the 2000s, it moved to producing higher-valued items but faced problems such as rising labour costs and industry-related environmental degradation. During the global financial crisis of 2008-2009, the region was hit even harder, with shrinking external demand for its exports.

Just when some critics were casting doubts on its future, the region is making a strong comeback. Backed by the central government, the PRD is investing heavily in modern infrastructure as well as in advanced industries based on Germany’s Industry 4.0 plan. It aims to make the PRD one of the most advanced industrial regions in the world and to be a metropolitan region the equal of London, Paris or Tokyo.

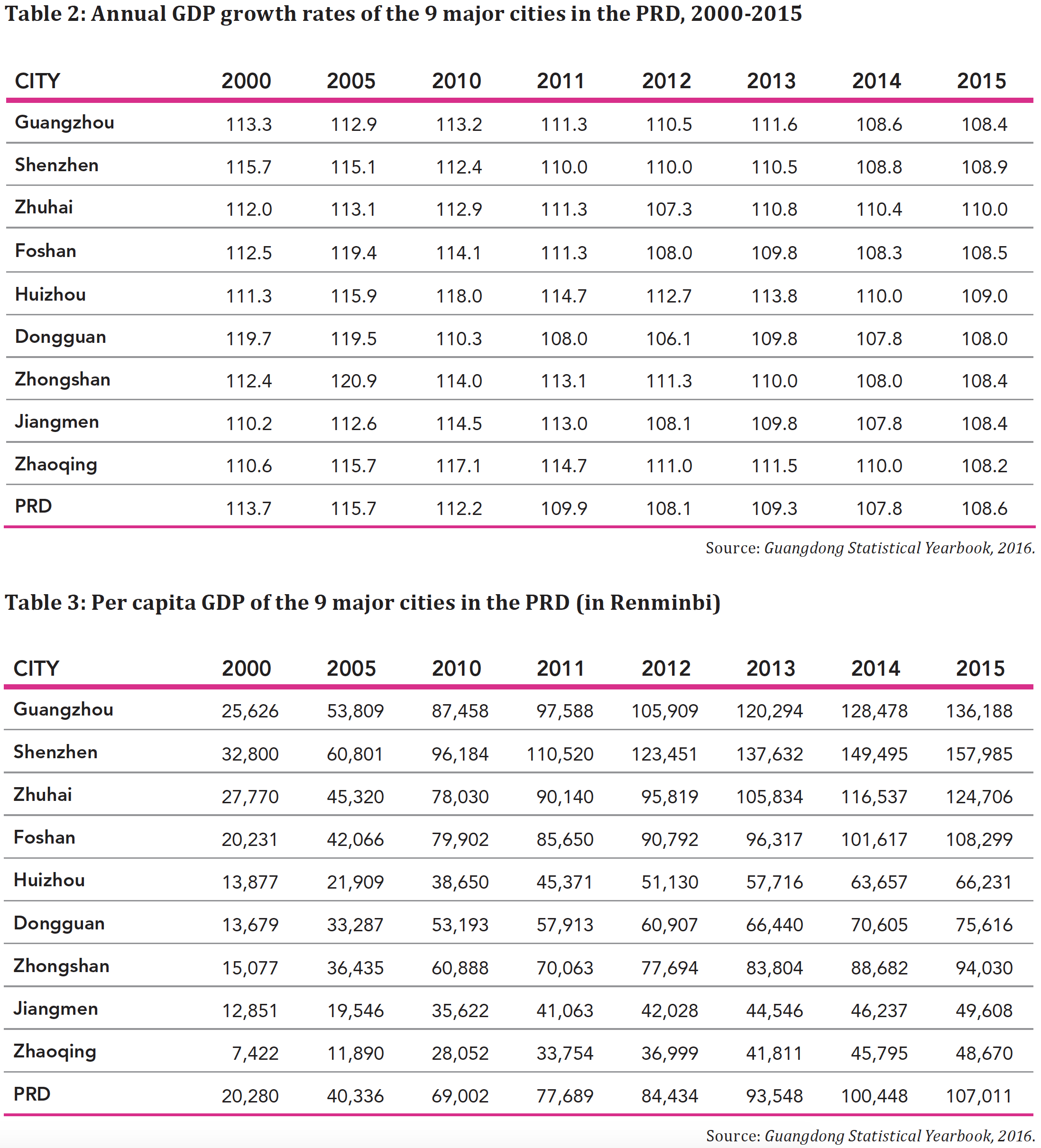

In terms of GDP, the PRD would rank as the 15th or 16th largest national economy in the world, on a par with Mexico and larger than Indonesia, the Netherlands, Turkey and even Saudi Arabia. In 2015, the region had a nominal per capita GDP of RMB107,011 (US$17,182), placing it among the richest nations in the world, ranked 39th. China as a whole only ranked 72th, according to the World Bank. The PRD’s two megacities, Guangzhou and Shenzhen, attained a per capita GDP of US$21,865 and US$22,106 respectively; each has a population of more than 10 million.

Modest beginning

The delta region was much smaller than it is today. It has taken centuries for rivers to build up the sand bars in the estuary. In the Han Dynasty (206 BC – 220 AD), Guangzhou was already the centre of the region and was known then as Nanhai and Panyu. Located in the middle of the delta region, Guangzhou has easy access to the sea. Its history is linked with that of the two Silk Roads – the first established in the early years of the Han Dynasty after the Chinese defeat of the Xiongnu (nomadic warriors from the eastern Asian steppes); the westward overland trade route went as far as the Roman Empire. The second was by sea. Limited by the navigational ability of sailing boats, the trading ports were first concentrated on the coast of present-day Vietnam and Hainan Island. As shipping technology advanced during the Tang Dynasty, the route was extended to Guangzhou, which became the main trading port with Southeast Asia, South Asia and even the Middle East. This was the maritime Silk Road to the Arabian world and Europe.

Guangzhou prospered as the starting point of the maritime Silk Road. Foreign quarters emerged just outside the city walls, with resident communities of Arabs, Persians, Jews, and others from present-day India, Sri Lanka and Indonesia. Guangzhou was already a metropolis more than 1,000 years ago. Silk products and ceramics were carried by sea from Guangzhou to Siraf on the northern shore of the Persian Gulf, and from there to the Middle East and Europe. In the late Ming Dynasty (1368-1644), Guangzhou had become the largest port in China, if not Asia, and the only one permitted to conduct trade with foreign merchant ships.

Silver became the international medium of exchange that integrated China and the economies of the Pacific and Indian Oceans. Two trade triangles emerged: Malacca – Macao – Nagasaki and Manila – Macao – Nagasaki, dominated first by the Portuguese and Spaniards; later, the Dutch also participated. Guangzhou sat at the centre of the two trade circles, integrating the domestic economy of China through foreign trade routes. High demand for exports transformed the neighbouring areas of Guangzhou into a large industrial region for the production and processing of silk, tea, chinaware, sugar, cotton cloth, ironware and salt.

The Opium Wars that led to the establishment of the treaty port system in China and Asia were an economic disaster for Guangzhou and Macao. Smuggling and the free-trade port of Hong Kong replaced Macao as the outer port for Guangzhou and other treaty coastal cities. Exports and imports were shifted out of Guangzhou to Hong Kong. Shanghai replaced Guangzhou as China’s most important foreign trade port.

The PRD region was transformed from a world factory and emporium of sophisticated products into an export-oriented industrial area processing raw materials. This industrialisation was disrupted when the region was occupied during the Japanese military from the late 1930s through 1945. During this period, the local population dispersed and the economy was devastated. Later, in 1949, facing economic sanctions from the United States of America and its allies, including the British colony of Hong Kong, the new communist government after 1949 responded by nationalising industries, finance and trade. It adopted a centrally planned economy and started large-scale industrial investment in major cities, including Guangzhou.

In the 1950s and 1960s, heavy industries like iron and steel, non-ferrous metals, coal and coke were produced in Guangzhou. Many small and medium-sized firms in the city were also merged and nationalised. The share of heavy industries rose from only 10 per cent in 1949 to 35 per cent in 1981.

New Industries

Because of recent industrial upgrading, the PRD economy is now witnessing a simultaneous development of different industries at different stages of development. These include labour-intensive sectors such as garments, shoes and furniture, that were once leading industries in the early stages of export-oriented industrialisation during the 1990s. Then there are the traditional capital and technology-intensive industries, such as automobiles, electrical appliances, metallurgy and petrochemical industries that developed in the region in the 2000s. Now, there are the innovative IT industries, including telecommunications equipment, smartphones, LCD display panels, semiconductors, high-speed railcars and other products that rely heavily on inputs of R & D; these will be the leading industrial sectors in the coming decades.

Despite a recent weakening of the traditional export markets in developed countries, the PRD region has been able to maintain its exports and trade surplus momentum thanks to the growth of emergent developing economies. In 2015, the region’s trade surplus was the equivalent of 22.5 per cent of its local GDP, a feat rarely achieved in economies of the same per capita GDP level, and especially noteworthy in the present era of economic uncertainty and growing trade protectionism.

Transformation of the PRD economy

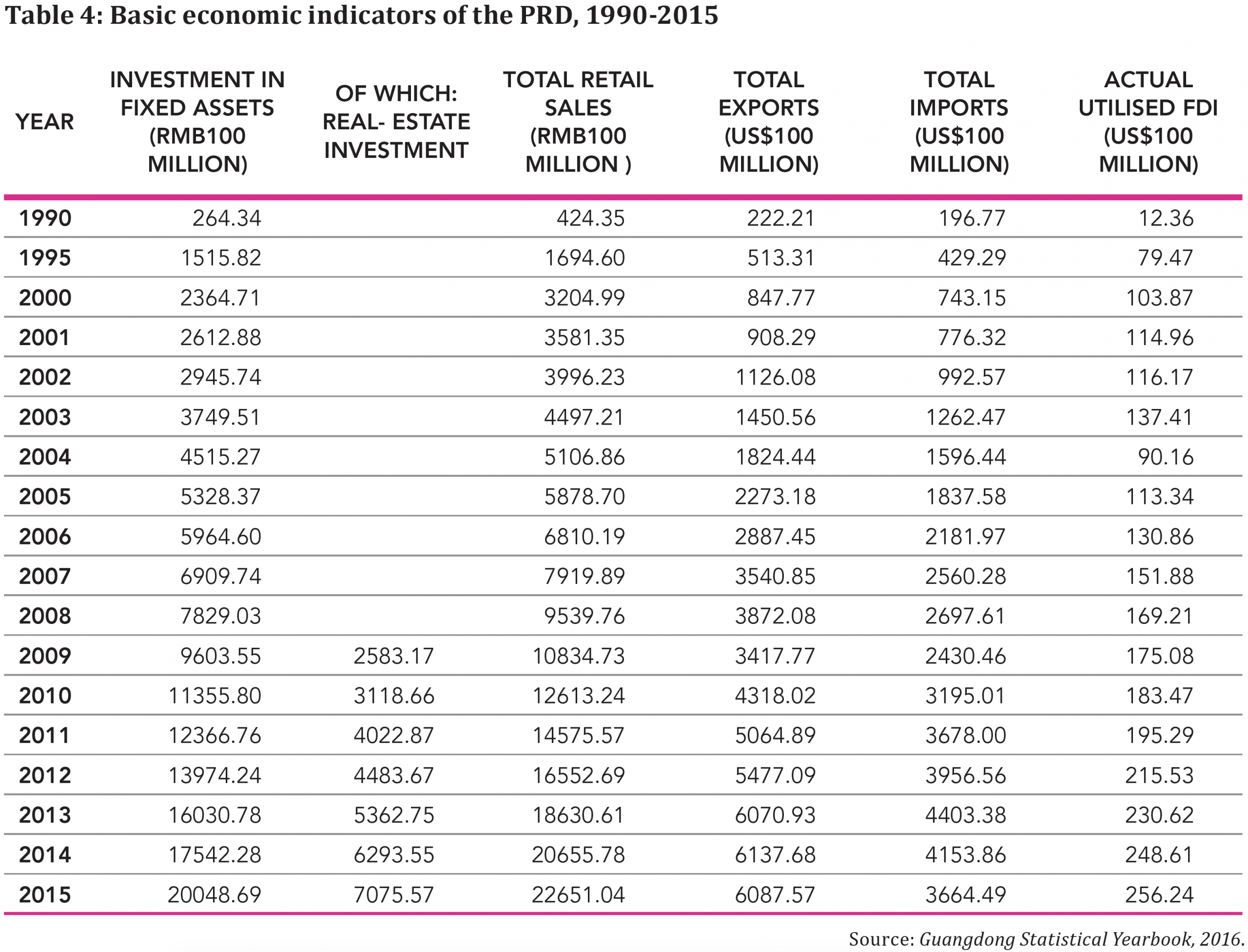

Heavy investment has been driving the region’s development. In the 1980s, the PRD region jump-started its industrialisation with export-oriented processing initiated by foreign investment from Hong Kong, Taiwan and elsewhere. This explains the overwhelming domination of foreign investment and industrial processing in the region, in contrast to the more indigenous industrial development of the Yangtze River Delta.

Industrial processing in Shenzhen and Dongguan had a spillover effect on other industries and services, both in terms of the extension of the industrial value chain as well as the resulting prosperity benefitting the local population. Since the beginning of the new century, the share and role of foreign investments have declined rapidly. Investment in the region in the last 15 years has been led instead by local infrastructure investment, including housing and indigenous industries.

In addition, local firms have begun exporting to new markets in developing economies. Foreign-invested firms still dominate the region’s export business, but their importance has rapidly eroded in the last five years. Local companies have been able to overcome cost inflation and to tap into the markets of developing countries. With over 300,000 small traders in Guangzhou from Africa, the Middle East and Iran, the city is thriving under the lucrative business model of exporting industrial products to emerging markets. Exports range from traditional labour-intensive garment and textile products to electronics and, more recently, smartphones.

The region’s capital power is also growing. In the last 15 years, foreign direct investment has lost its significance as a source of foreign exchange for financing imports. The steep rise in trade surpluses underlies the success of import substitution for the region’s industries as a whole. The PRD has been a net exporter of capital, technology and management, relocating labour-intensive industries to other overseas low-cost production destinations such as those in Southeast Asia.

Pearl River Delta upgrades industrial sector

China maintains a strong manufacturing sector, with Guangdong always spearheading the drive for industrialisation and economic transformation. Contrary to dominant Western economic theories saying that the service economy will replace industry as economies develop, and despite similar rhetoric of some Chinese economists, the PRD regional economy has persisted in its efforts to upgrade local industry.

There has been relocation of industries, but mostly within the region and not outside, except by foreign-invested firms seeking lower costs. The industry is still the priority of PRD city governments. There has not been any significant sign of retreat of local industries. Instead, there has been much industrial upgrading and adding of new industries, mostly in advanced machinery and smartphone production. The region as a whole is still predominantly a manufacturing area, with a dominant share of global output. If China is still the factory of the world, the PRD is at the forefront helping the nation hold on to this claim.

Backed by the central government, the PRD is investing heavily in modern infrastructure as well as in advanced industries based on Germany’s Industry 4.0 plan. It aims to make the PRD one of the most advanced industrial regions in the world

The region has followed an economic trajectory similar to that of Germany in recent years, but with an even stronger emphasis on industrial upgrading. When markets in China and overseas expand rapidly once again, the PRD’s upgraded and expanded industrial capacity will likely be capable of competing with global titans like Tokyo, Paris and London.

The PRD’s rapid industrialisation since 1978 has supported the growth of a strong urban middle class. As a result, commercial activities are flourishing on the basis of rising incomes and a positive economic outlook. The region’s recent consumption has been stronger than that of Beijing and Shanghai.

In 2015, the Chinese government announced Made in China 2025, a comprehensive industrial policy that advocates abandoning historic adherence to export-oriented industrialisation and replacing it with a forward-looking plan based on Germany’s Industrie 4.0. The policy offers a timely blueprint for China’s economic transformation in the 21st century. At the local level, provinces and major industrial cities have formulated their own versions of long-term industrial transformation within the national framework.

Industrial Champions

Some domestic companies, with the support of both local and central governments, have become industrial champions. Shenzhen-based Huawei, now the largest telecommunications equipment manufacturer in the world and a global smartphone brand, is one example. Midea from Foshan, Gree from Zhuhai and TCL from Huizhou have also transformed themselves into global leaders of electrical appliances by consolidating their global dominant market positions; they have become leaders in diversification and automation upgrading as well as through international mergers and acquisitions. Midea’s recent acquisition of Toshiba’s white goods department is a prominent example of the newly acquired global competitiveness of these firms backed by local state investment from the PRD.

Even IT giant Huawei has faced recent challenges from local smartphone producers within the region. In Dongguan, previously little-known local brands OPPO Electronics and Vivo have captured top market positions in China – the world’s largest market – from Huawei, Samsung and Apple. And while OPPO and Vivo do not have strong local state investment, Huawei and ZT (also from Shenzhen) are beneficiaries of government policies and credit support. This unexpected and self-created success has propelled the two PRD firms into the top six global smartphone companies as of the third quarter of 2016, outperforming both Chinese brands and global titans like Apple, Samsung and LG. Shenzhen-based automaker BYD is yet another PRD success story best known for its electric cars and buses.

Advanced manufacturing

Following Germany’s intelligent industrial development model, Guangdong’s government has divided the PRD region into two parts: an industrial zone of advanced IT industries on the east side of the Pearl River and another zone of advanced equipment manufacturing on the west side. Both produce finished consumer products. The region’s engine of growth is its advanced equipment and IT industries which marry new digital network technology with classical industrialisation.

The Chinese government has aggressively pushed the development and industrialisation of 5G mobile telephony. As 5G technology will be 1,000 times faster than 4G (which was only 10 times faster than 3G), it will constitute a disruptive technology that will impact the entire environment of production, consumption and even everyday life. Telecommunications and Internet firms in Shenzhen and Dongguan are currently the leading global players pursuing this new technology. With massive investment in this sector, the PRD, and the nation as a whole, is poised to become the founding father in the commercialisation of 5G technology and related business models.

There will certainly be division of labour and cooperation between the PRD’s services centres and those of Hong Kong and Macao. The PRD region has been pushing a greater integration of its nine major cities, with a combination of inter-city fast railways and metropolitan subways, mostly in Guangzhou and Shenzhen. By 2020, there will be 16 inter-city railway lines running at 200 kilometres per hour; Guangzhou, Shenzhen and Zhuhai are the centres for integrating the region into a one-hour core region. By 2020, total mileage of inter-city railways will be 650 kilometres. By end-2016, 350 kilometres will be in operation. All the cities will soon be connected by rail within one hour of each other.

Greater Metropolitan Region

Guangzhou, the PRD’s transport hub and regional service centre is working hard to develop an extensive subway network. By end-2015, the city had nine lines with a total of 266 kilometres in operation; another 11 lines of a total of 298 kilometres are under construction. In late 2015, Guangzhou set an even more ambitious target: to build an additional 15 lines of 413.5 kilometres within the next 10 years. In all, the subway mileage of Guangzhou will be twice that of Hong Kong soon.

With such a dense transport system, the PRD area will become one of the great metropolitan regions in the world, with a degree of connectivity on a par with Greater Tokyo, Greater Paris and Greater London, but with faster trains and more modern facilities. This will help to integrate the numerous local industrial upgrading initiatives and greatly facilitate both producer and consumer services. In the process, Hong Kong and Macao should join the PRD region in implementing its ambitious agenda and adjust their existing development trajectory accordingly. If not, they will miss the many great opportunities that have opened up in this new chapter of China’s economic development.